Imagine industries operating without rules: a chaotic, unpredictable environment where public safety is uncertain. Regulatory frameworks prevent such disorder by establishing essential rules to guide organizations and individuals. Modern approaches, however, focus on aligning these frameworks with effective risk management rather than relying solely on checklists.

This article examines the foundation of regulatory frameworks, exploring their purpose, structure, and key elements.

Key takeaways:

- A regulatory framework is a set of rules and regulations implemented by governments to ensure compliance and protect the rights of individuals and businesses

- The primary objectives of a regulatory framework include ensuring compliance, protecting rights, promoting fair competition, and enhancing public safety

- Modern compliance strategies integrate regulatory frameworks with risk management to address real-world challenges and move beyond checklists

Definition and importance

A regulatory framework is a system of rules and guidelines designed to ensure compliance and evaluate the broader impacts of regulations.

These frameworks establish clear standards for industries and sectors, providing consistency and accountability. They protect consumers, the environment, and public interests by enforcing quality and safety requirements for products and services.

In the financial sector, for example, organizations like the Securities and Exchange Commission (SEC) in the United States combat fraud and protect investors through rigorous oversight.

Impact assessments within these frameworks allow authorities to evaluate outcomes, enabling data-driven decisions that influence industries and the socio-economic landscape.

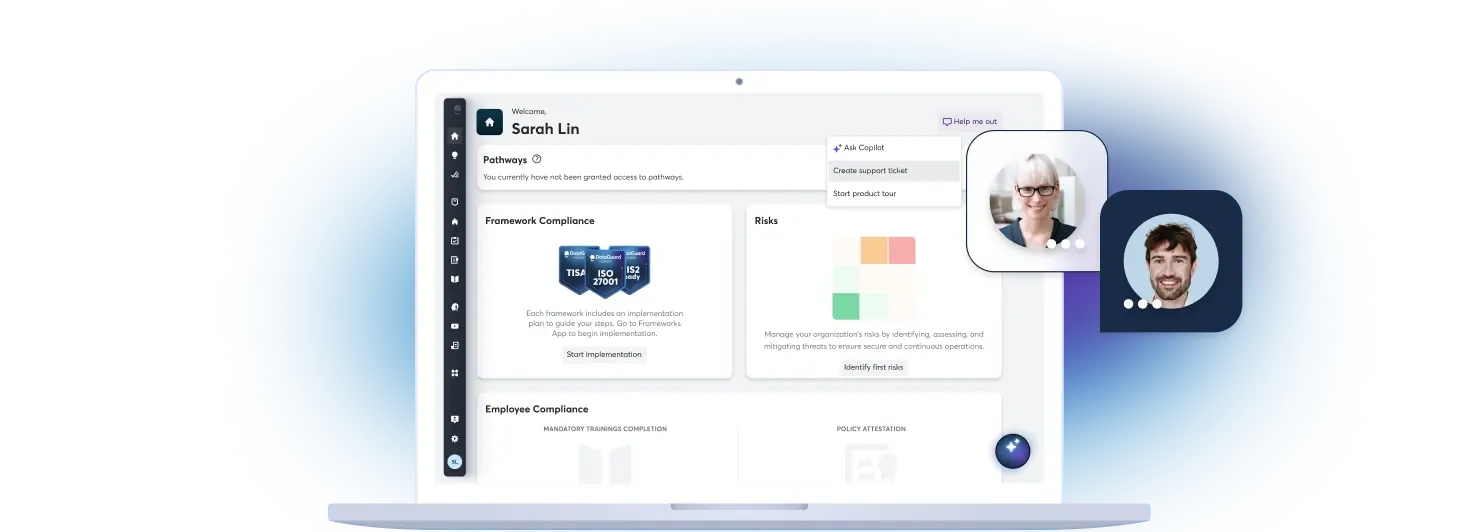

Strengthen your information security posture

From building an ISMS to risk management and employee training, DataGuard helps you secure what matters most.

Primary objectives of a regulatory framework

The primary objectives of any regulatory framework are to ensure that regulations serve the public interest, facilitate compliance, and support the work of the regulator in overseeing adherence to these rules.

Ensuring compliance

Compliance within a regulatory framework involves setting clear registration requirements and monitoring organizations to ensure adherence. This process is vital across sectors like healthcare, finance, and environmental protection.

In healthcare, it ensures medical facilities meet licensing standards and protect patient privacy. Financial institutions must follow anti-money laundering laws and submit regular reports. Environmental regulations require companies to document emissions and waste practices, with audits ensuring accountability.

Protecting rights

A key function of regulatory frameworks is safeguarding the rights of individuals and organizations through the enforcement of codes of practice that ensure fairness and legal protection.

These codes govern sectors such as healthcare, finance, and education, setting standards for ethical behavior and accountability. For instance, in healthcare, the Health Insurance Portability and Accountability Act (HIPAA) in the United States protects patient privacy and health information.

In finance, regulations like the Dodd-Frank Act and Consumer Protection Act promote transparency and prevent unfair practices, fostering trust and ensuring fair treatment for consumers and investors.

Promoting fair competition

Regulatory frameworks create a balanced business environment by setting rules that prevent larger corporations from gaining unfair advantages, supporting medium-sized enterprises in particular.

In sectors such as telecommunications, policies limiting monopolistic practices ensure smaller businesses can compete effectively. These frameworks protect against anti-competitive behavior while fostering conditions for growth and innovation.

Enhancing public safety

Regulatory frameworks prioritize public safety by issuing notices and enforcing safety standards that industries must follow.

In aviation, for instance, the Federal Aviation Administration (FAA) issues airworthiness directives to address safety concerns and mandate corrective actions, helping to prevent accidents and maintain consistent safety protocols.

Routine inspections and audits ensure compliance with these regulations, holding organizations accountable for violations and reinforcing a culture of safety across industries.

Take control of GDPR compliance with smart tools that save time

Components of a regulatory framework

A regulatory framework includes registration requirements, mandatory information submissions, and the issuance of regulatory notices and guidance. These elements provide a structured approach to governance and compliance across industries.

Registration and notification requirements

At the core of regulatory frameworks, registration and notification processes establish initial conditions and require timely updates to ensure compliance. These measures promote transparency, uphold legal standards, and reinforce accountability across industries.

In healthcare, providers register with regulatory bodies to align with professional standards and ensure patient safety. In finance, institutions report significant operational changes to authorities, mitigating risks and protecting consumer interests.

Information submission requirements

Compliance with submission requirements maintains transparency and accountability within regulatory frameworks.

Timely and accurate filings enable regulators to monitor adherence, identify irregularities, and evaluate financial performance. These reports provide essential insights into an organization’s operations, supporting informed decision-making by stakeholders.

The data also facilitates industry benchmarking, trend analysis, and the development of regulations that support economic stability and fair competition.

Regulatory notices and advice

Effective regulatory frameworks rely on notices and advice to communicate expectations and best practices. These tools connect regulators with the organizations they oversee, ensuring clarity on new rules, identifying potential risks, and detailing actionable compliance steps.

For instance, financial regulators may update reporting requirements or anti-money laundering protocols through formal notices. Similarly, health and safety regulators issue guidance to help industries maintain workplace standards.

Engaging with these directives allows organizations to address regulatory challenges proactively, minimize risks, and sustain a culture of compliance.

Stay ahead of cyber threats with expert advice

Get practical insights and advice to boost your security posture—straight to your inbox.

The Better Regulation Framework

In the United Kingdom, the Better Regulation Framework streamlines the creation and review of regulations to ensure they are effective, efficient, and evidence-based. It requires policymakers to assess the impact of proposed regulations on businesses, the economy, and society, with oversight from the Regulatory Policy Committee (RPC). By focusing on accountability and proportionality, the framework ensures that regulations address key issues without imposing unnecessary burdens.

Guidance and supplementary notes

The Better Regulation Framework provides detailed guidance and supplementary notes to help entities meet regulatory requirements effectively. These resources assist businesses in navigating complex rules, minimizing the risk of non-compliance and associated penalties.

For example, financial sector guidance on anti-money laundering procedures ensures organizations fulfill legal obligations. Supplementary notes include practical examples and case studies, clarifying how regulations apply in real-world scenarios and enhancing understanding of compliance expectations.

Transitional period and applications

The transitional period in a regulatory framework provides time to adapt to new regulations and submit required applications for compliance. This phase enables organizations to assess the impact of updated requirements and make adjustments before full enforcement begins.

Applications such as license renewals, permits, certifications, or registrations may be required depending on the industry. This period serves as a buffer, allowing businesses to align with regulatory changes while minimizing operational disruptions.

Post-implementation review

Assessing regulations after implementation is an integral part of the Better Regulation Framework, examining their real-world impact to evaluate effectiveness and efficiency. These reviews help uncover unintended consequences and identify areas for improvement within the regulatory framework.

For instance, in the financial sector, such reviews have refined banking regulations to better protect consumers and maintain financial stability. By analyzing regulatory outcomes, policymakers can ensure objectives are met and make informed decisions to enhance future regulations.

Assessment templates

Within the Better Regulation Framework, assessment templates provide a consistent method for reviewing policies to ensure thorough and uniform evaluations. They help policymakers analyze the impacts of proposed regulations across different sectors and stakeholders.

For example, an environmental regulation template might include criteria such as emissions reduction targets, biodiversity conservation, and cost-benefit analysis. This systematic approach highlights potential gaps and unintended consequences, enabling more effective policy design.

Strengthen your organization with risk-driven compliance

Regulatory frameworks establish the foundation for compliance, protecting rights and promoting fair competition across industries. Effective compliance strategies, however, take this further by integrating risk management to address real-world challenges and strengthen protection.

By aligning regulatory requirements with proactive risk management, organizations can build resilience and achieve long-term success. This approach not only ensures compliance but also drives innovation, supports sustainable growth, and prepares businesses for a dynamic future.

Frequently Asked Questions

Who creates a regulatory framework?

A regulatory framework is usually created by government agencies or regulatory bodies that have jurisdiction over a particular industry or sector. These bodies have the authority to enforce the regulations and ensure compliance from businesses and organizations.

What are some examples of regulatory bodies?

Some examples of regulatory bodies include the Federal Trade Commission (FTC) for consumer protection, the Securities and Exchange Commission (SEC) for financial markets, and the Food and Drug Administration (FDA) for regulating the food and pharmaceutical industries.

How does a regulatory framework impact businesses?

A regulatory framework can significantly impact businesses by imposing certain requirements and restrictions on their operations. These can include regulations on pricing, advertising, safety standards, and environmental practices, among others. Non-compliance with these regulations can result in penalties and fines for businesses.

Is a regulatory framework the same as a law?

No, a regulatory framework is not the same as a law. While a law is a binding legal rule enforced by the government, a regulatory framework is a set of rules and guidelines created and enforced by regulatory bodies. However, non-compliance with a regulatory framework can still lead to legal consequences.